Q&A with Mr. Jeppe Lenstrup, Regional Manager at Container Providers International, Copenhagen, Denmark

When was Container Providers (CPI) established and who are the owners of the company, where is the head office/branch office and what is your head count?

CPI was founded in Copenhagen October, 1978. Our 40 year anniversary is coming soon. Inge and Henning Nielsen founded CPI and are still pulling the strings. Today we are 35 people worldwide working from own offices in Copenhagen, Antwerp, Montpellier, Durban, Dubai, Shanghai and San Francisco.

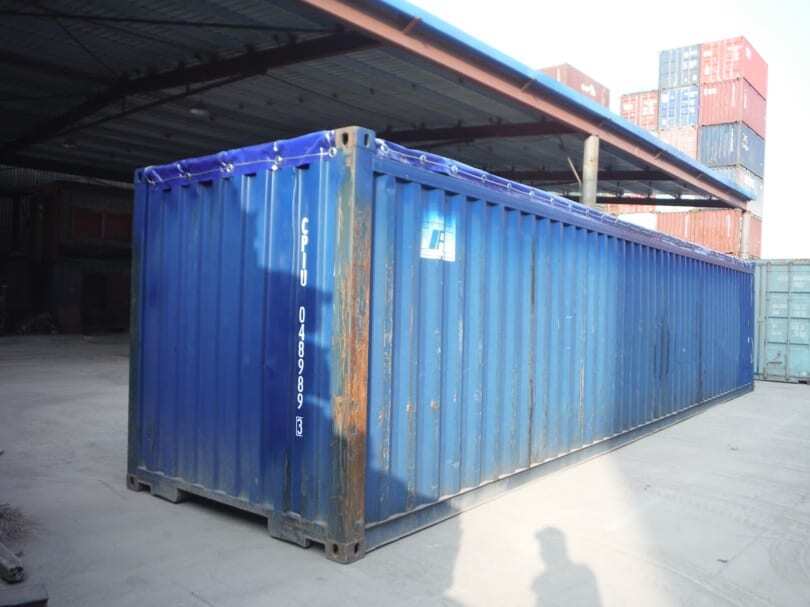

As the name implies you provide containers, give us more information on the types of containers, new, used, etc.

We work on 2 markets. One market is providing Shippers Own Containers (SOC) for straight sale, one-way use or sale with a buy back option. We want to be the only SOC supplier the forwarder or cargo owner (shipper) needs to call so we have to have all types and sizes available. Including: Drys, Open Tops, Flatracks, and more or less everywhere. We have thousands of units that are ready for prompt release worldwide.

The other market we work on is the new container. That has surpassed our SOC business in volume. We build each month about 1,300 TEUs. Most of our new builds are standards for sea and railway use. The end-user market for containers is enormous, especially for units that are prepared for the final customer’s needs. E.g. full side doors, grid floor and liquid waste tanks under the floor. The trick is to match the customer’s needs and still make the containers within ISO and CSC regulations. That way the units can be moved inexpensively by container ships to their final destination, maybe even with cargo.

Who are your main customers, freight forwarders, shippers? Tell us some examples of bigger deliveries/sales you have had.

Over time it’s the many smaller projects and sales to local container dealers that make up the bulk of our business. It is the bigger projects that we learn from and that change our business. Examples big projects would be the dismantling and export of a used factory or the building of a new factory. We are selling to the same suppliers of factories as we did 20 years ago. Of these suppliers their machine production or subcontractors are often no-longer located in Scandinavia or Europe. Therefore our ‘big project’ customers need their SOCs in new locations. We have moved along and made a setup for selling in those locations. Today we sell more containers in China, India and Turkey than in the USA and Europe, including selling to local dealers and forwarders.

Why would one buy or lease containers and not use the ship-owner’s containers?

You buy or lease to save on detention, save on transport and to serve your customer when shipping lines fail to serve you.

Avoiding the shipping line’s detention is often enough reason. Our normal lease rate for a SOC 20DC is ~ USD 1.00/day/20DC with no time limit. Compare that with the shipping line’s detention. The differences are bigger for special containers.

Also transport cost can be cut. Earlier SOCs were primarily used for very remote destinations with poor infrastructure where costs of bringing units back to the shipping lines depot exceeded the purchase price of the SOC. With the one-way leasing or a buy-back option it’s much easier to save money on SOCs. Many of our customers one-way lease SOCs with both the pick-up and return of the units in inland USA, Europe and Asia. They simply save money on not having to transport the containers back to ports.

Finally, SOC are used when shipping lines fail to deliver the containers on time. That is often the case with Open Tops and Flat racks, but lines may even fail to supply standard Dry containers on time.

Today what is the typical price for a 20’/40′ container? When buying a container how about the status of the container? How does the buyer ensure that it is accepted for ocean transportation by the shipowner? Explain what kind of checks/license systems are in place for containers that you buy 2nd hand.

The prices vary a lot depending on location. That being said, the prices today are generally historically low. In Antwerp, a 40’DC that is ready to go costs Usd 950 and a 20’DC Usd 850.

The inspection standards for SOC are very well implemented internationally. Ask for sound, cargo worthy conditions including a CSC (container safety convention) valid for 12 months. That will be accepted by all shipping lines. However, some shipping lines also insist that a data sheet for each container is filled out prior to shipment. That can be a bit of a pain as the data often only can be noted from the container door. Therefor insist on getting it from your SOC supplier and you are home free.

If I wanted to ship a big machine and I want to modify a 40ft container into an open top is that something you can do ? If this container arrives say in Senegal would you have contacts to buy it back and use it again ?

Making 40’OT out of 40’dry containers is the only way we can meet the high demand for shipper’s own 40’OTs. There are many companies making modified 40’OTs and there are many designs that are used. Some of them can be used just like original OTs, others have only temporary, not extendable CSC validity, and sadly many modified 40OTs cannot be used legally at all. If the supplier cannot present a proper Lloyds certificate confirming that the unit can be used as an ISO 40OT, then the CSC plate on the unit is actually a fraud.

As for us buying back or leasing our modified 40OT, we happily take our modified 40OT back in most places.

One thing which shippers tend to overlook is the likelihood of getting a repair invoice when a 40OT is re-delivered. The tarpaulins are fragile (both on original and modified OTs) and shippers have to make sure that their site at the destination carefully re-fit the tarpaulins after having stripped the units. We often get 40OTs back with torn tarpaulins, if not completely missing.

Do you face a lot of competition these days? How are the ship owners about accepting containers that are not their own or leased?

Even using a conservative figure there are at least 600,000 containers being phased out from shipping lines service annually. Consequently, there are a lot of people buying and selling containers. We have the advantage of operating on all continents and being 100 % self-financed.

As for the shipping lines’ view on SOCs, often the lines do not have sufficient own Open Tops or Flat Racks to offer shippers. In such cases they of course welcome SOCs. Otherwise their enthusiasm towards SOCs depends on the destination. If having SOCs on board their vessels increases the line’s own container shortage at the destination – then you may be charged a shipper’s own fee.

Where are most containers built today and has something changed in the last few years regarding production of containers? With rates of freight under pressure is the quality of containers also getting lower (i.e. saving costs) or are there standards for containers that must be followed?

There is hardly any container production outside China today. Certainly, not of standard ISO shipping line units. It is not only the price/quality that make it so, in China, there is always cargo available to all destinations in the world. So new containers can be used with cargo right away instead of first being shipped empty to a place with cargo or empty all the way to where the customer is.

The quality of the work at the container factories is a big issue of concern. If you are not present during the production to make sure that you get the quality you ordered, then it’s like saying that it’s not important to you. We always have our own surveyors staying at the factory during production.

The official standards for shipping line containers are still high. Some ISO designs use thinner panels than earlier which of course make the units lighter and less strong, but the max gross is the same as before, so with the lower tara weight the payload has increased.

If I wanted to buy 2×20 containers in Buenos Aires to whom should I direct my inquiry? If I am in Asia, Europe, Africa or the Americas with whom should our readers speak?

If you already know someone from CPI Group then call him or her. We can all help with all inquiries, otherwise call office nearest to you. Details are on www.cpigroup.com

How do you view the future of 2nd hand container trade? Does the demise of Hanjin and their more than 500,000 boxes mean anything to the current market?

To get an idea of how many units that are coming up for sale look at how many that were built 12-15 years ago. That volume will soon pass a million units annually. Basically, the only way to create a market for such volumes is to sell cheap. For the shipping lines and container lessors that is bad news. Many have high residual values on their books. Their problem is that if they stop building new and instead try to extend the lifetime of their old equipment, then the maintenance cost of the old units will exceed the depreciation cost on new equipment. They have to sell. For the shippers and container traders the situation is perfect. The cheaper the second-hand containers are the more projects can benefit from using SOCs.

The Hanjin bankruptcy actually created an instant lack of containers for the many shipping lines that wanted to get the cargo bookings Hanjin would normally have got. The lines could not use the Hanjin units as they were all arrested, so they had to lease. But the Hanjin units are beginning to be released from the terminals and depots that have blocked them. We expect that many of the ex-Hanjin units will be offered as lease units to shipping lines as they are generally quite young. However, we are also beginning to see them on the sales market as well.

Interviewee:

Jeppe Lenstrup

Container Providers International Aps

jl@cpigroup.com

www.cpigroup.com