Interview with

Mr. Naranbaatar (Nikkie) Chantuu

Logistics & General Manager

First of all Nikkie, could you tell our readers about the history of TM Infinity, Mongolia?

We are a Mongolian customs’ licensed freight forwarding and cargo handling company with the name TM Infinity, registered in January 2019.

At TM Infinity, we meet all your global transportation needs at the best rates (very competitive). Whether you are flying any item no matter how sensitive, for instance general cargo and shipment from your country or vise-versa, you can count on us to get your cargo where it’s going to, on time and its safety guaranteed.

TM Infinity LLC is an International Freight Forwarding company providing a broad range of services in the field of transportation. By choosing TM Infinity LLC, you have selected a firm that has built its reputation on the highest service standards facilitated by an experienced organization. We are offering comprehensive international and domestic transport logistics services to our customers, using all kinds of transportation (such as rail, air, sea and auto); our specialist knowledge and skills; and a network of over 200 agents which are located in over 90 countries of the world.

With the aim of being the best choice in international freight forwarding service, we will be engaged in self-development and being professionals permanently, by providing reliable service that meets quality standards and a constantly improving satisfaction of the interested parties.

Our specialists are selected professionals who have many years working experience in the transport sector. We have built up the broadest network of transport agents all over the world. We have a fast and trusty service. Also, we can quickly organize any freight from all over the world by any transportation.

We strongly believe that TM Infintity LLC will be a great professional choice to connect landlocked Mongolia by transport and logistics with all other countries, as well as reliable service to bring you business success.

Our freight forwarding services include:

• Custom Brokerage

• Shipping and vice-versa to most world-wide locations

• Freight Forwarding Consultancy

• Cargo Consolidation World-wide

• Warehousing Services, Distribution and Delivery

• General Supplies

• Qualified personnel for handling dangerous goods

• Logistics

• Option of carriers based on your cargo needs

• Merchants

• Door to Door services

Mongolia is a landlocked country. Enlighten our readers about the best way to reach Mongolia. I suppose that the gateway via the Chinese port of Tianjin is the best? Is trucking an option from the Chinese port to Mongolia, and do you need to transload the cargo on the border?

The port of Tianjin is an important transportation and logistics center for Beijing, the capital of China, and for our landlocked country. Covering an area of 121 square kilometers, and one of the world’s 10 largest seaports, Tianjin has 217 cargo ports along 32 kilometers of coastline. As far as we know,the Chinese port of Xinjiang (Tianjin) has stopped importing goods to Mongolia. Currently, more than 4,000 containers have been delayed. As a result, the number of containers shipped from third countries is increasing day by day.

COSCO Shipping Lines, Mongolia’s largest shipping company, and other shipping companies are continuing to change container lease conditions, pricing, and tariff policies for containers expected to move at the port and for new containers at the port due to the situation at the Chinese port of Xinjiang (Tianjin). The shipping companies, which account for the majority of container traffic to Mongolia, have been increasing the price of containers several times in advance since May of last year due to the longer service life of the container, leading to a sharp increase in total shipping prices. In addition, due to overcrowding at Tianjin and other ports in China, many unforeseen additional costs have been added to the cost of transporting goods from China to Mongolia such as those associated with container storage, rental costs, and the transfer of containers from site to site due to overcrowding. The issue of charging from freight forwarding companies is widespread. The situation in 2021-2022 is unprecedented in the history of the transport and logistics sector of Mongolia. Since the middle of the 1st quarter of 2022, we have been using trucking options from transit ports and main export goods. Transload by train we are doing on the Mongolian side of the custom board, mostly for transshipment.

Mongolia is a very huge country located between Russia and China. Business-wise and logistics-wise, how is the efficiency of transit nowadays between Mongolia and your two neighbors? Can you elaborate a bit on this and perhaps also provide some advice to our readers about the best way and practice to either export to or import from Mongolia?

With the support of the Ministry of Finance of the Republic of Korea and the KOTRA Foreign Trade and Investment Promotion Agency, the Korean Knowledge Sharing Program will develop Mongolia’s freight, logistics policy and regulations, analyze logistics infrastructure, identify key locations and points, and provide smart logistics. Starting from January 2021, the aim is to plan possible system solutions, strengthen the capacity of Mongolian government officials and experts in this field, and develop a training program for smart logistics coordinators and experts.

How is the Corona situation right now in your country?

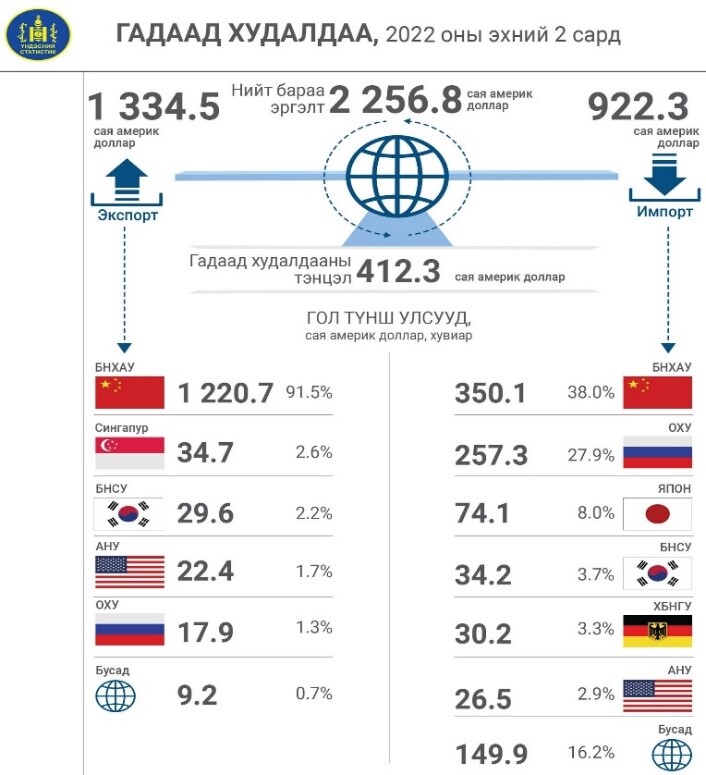

An overview of the economic impact of the pandemic due to Coronavirus infection indicates that Mongolia’s economy is likely to be hit hard by the epidemic and related traffic restrictions. In the first half of 2020, gross domestic product (GDP) decreased by 9.7 percent. In the first eight months of 2020, exports decreased by 16.9 percent and imports by 15.6 percent compared to the same period of 2019. Mineral output has declined by 25.5 percent. Another sector that is most affected by the pandemic is the transportation sector, which is closely linked to the mining sector. In September, the Asian Development Bank (ADB) cut Mongolia’s 2021 economic growth forecast from 2.1 percent and in March to 2.6 percent.

Mongolia’s ability to cope with and overcome sudden economic difficulties is limited. The country’s external debt is relatively high, accounting for about 70 percent of GDP. In addition, the maturity of Mongolian government bonds is approaching. One of the most important issues was the swap agreement between the Central Banks of China and Mongolia, which was scheduled to expire in 2020. In August, the Bank of Mongolia announced that it had extended the 15 billion yuan ($ 2.2 billion) loan swap agreement until 2023. In October, Mongolia issued a 5.1 percent bond called Nomad, raising $ 600 million to pay off past-due bonds.

Has worked In this position from 2019 to present for TM Infinity

LLC and has worked in this field for 6 years.

Do you have direct flights from overseas into Ulan Bator and if so from where?

Currently, we have direct flights by MIAT (Mongolian Airlines), Aero Mongolia, Air China, Turkish Airlines, Korean Air, direct from USA-LA, Russia-Moscow, Irkutsk, Ulan-Ude, Kazakhstan-Alma-Ata, India-New Delhi, China- Beijing, Hoch hot, Japan- Tokyo, Narita, Turkey- Istanbul, Germany- Berlin, Frankfurt, Thailand- Bangkok, Hong Kong, Singapore, Korea- Busan, Incheon, Australia- Sydney, Brisbane. Also MIAT signed a cooperation agreement with LUFTHANSA, for flight connections to other countries.

Mongolia is rich in mineral deposits and has a strategic location as mentioned before. What kind of minerals and deposits do you have in your country, and what can you tell our readers about your country if you should give a brief history?

Impact on the oil and gas sector:

Mongolia produces a small amount of crude oil (6 to 8 million barrels per year) and exports it to China. Crude oil exports have declined due to border restrictions and have not recovered much. In the first three months of 2022, Mongolia exported only 1.8 million barrels of oil, a decrease of more than 50 percent compared to the same period in 2021.

Coal exports:

The main export products are coal and copper concentrate, and mineral exports in the first three months of 2022 decreased by 30 percent compared to the same period in 2020. Mongolia has experienced a sharp trade shock earlier than other countries due to the closure of its borders at the beginning of the epidemic (late January 2020).

Coal prices remain stable. The main reason for the decline in exports in the first quarter was the closure of the border with China. Despite the reopening of the border (the Mongolian government lifted restrictions on coal shipments on March 23 [ed. note: 2021]), strict health requirements for truck drivers continue to have a negative impact on exports. By mid-July, coal shipments to China were close to pre-epidemic levels. However, total coal exports in the first eight months of 2021 decreased by almost 40 percent compared to the same period in 2019.

The Mongolian and Chinese governments have reached an agreement to ensure that China does not stop exporting copper concentrate from Mongolia. In this regard, there were no significant difficulties in exporting copper concentrate from Oyu Tolgoi and Erdenet (although copper prices declined in the first four months of 2020). The challenges of bringing foreign engineers and managers, who play a key role in construction, to Mongolia are slowing down the long-awaited underground development of Oyu Tolgoi. Drivers of trucks transporting coal and copper to China are required to undergo a viral test at the border and will be detained if they are found to be infected with COVID-19. If the number of coronavirus cases rises sharply, Mongolia is likely to close its borders again. This means that in addition to Mongolia’s copper concentrate and coal export costs, there is still a risk of significant vehicle access constraints.

Gold trade:

The impact of the pandemic on gold mining is likely to be positive due to rising gold prices, and the government is considering the sector as a priority. Although important, it is important that environmental standards are met and that there is no risk to government revenue generation. Most of the mined gold is purchased by the Bank of Mongolia and sent for recycling, which is used to increase foreign exchange reserves or to trade on the open market. Gold from Oyu Tolgoi’s copper concentrate is sold to a Chinese smelter. Compared to the same period of the previous year, the amount of gold sold to the Bank of Mongolia in the first quarter of 2022 increased significantly. The BOM’s chief economist attributed this to a rise in gold prices during the pandemic or a reduction in illegal gold trade due to border closures.

How to get in touch with you?

Here are my contact details:

Nikkie Chantuu

Phone: +976 80004209

Office: +976 76100001

E-mail: sales_1@tminfinity.mn, sales@tminfinity.mn

Website: http://tminfinity.mn/

Facebook Page: TM Infinity LLC | Facebook

Office address: #209 TI Business Centre, Workers Street 16010, 5th khoroo, Bayangol District, Ulaanbaatar, Mongolia